Already a subscriber? Sign in to unlock Premium on the website.

Use the “Sign in” link in any newsletter for one-click access.

From the Editor

As we approach Christmas and the close of another eventful year, this issue reflects on the forces shaping 2025. From AI agents moving into operational roles, to shifting consumer confidence and ongoing geopolitical tensions, the world is accelerating into new realities.

We highlight stories that matter—technological leaps, economic inflection points, and security challenges—while examining their implications for the year ahead. We hope this issue informs, provokes thought, and sparks conversation.

Please share this issue using the link at the end. Merry Xmas.

David Eifion Williams

Editor & Founder

TOP STORY

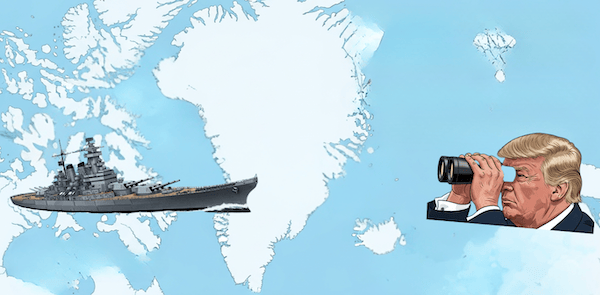

Trump Flexes American Power on Three Fronts

President Donald Trump pushes Greenland acquisition, unveils battleship fleet but faces Venezuela deportation setback while targeting sanctioned oil tankers.

Trump looks at Greenland for US national security and plans “Trump-class” battleships.

President Trump appointed Louisiana Governor Jeff Landry as special envoy to Greenland, declaring the Arctic territory essential to US national security. Denmark's foreign minister summoned the US ambassador, calling the annexation push "totally unacceptable."

At the same Mar-a-Lago event, Trump unveiled plans for new "Trump-class" battleships as part of a "Golden Fleet" initiative. The administration plans to build 20-25 vessels, with the first two expected within two and a half years, though the US hasn't built a battleship since 1994.

Meanwhile, a federal judge ruled the US denied due process to Venezuelan men deported to El Salvador's CECOT prison after Trump invoked the 1798 Alien Enemies Act. Judge Boasberg gave the government until April 23 to demonstrate the deportees were actually gang members.

Trump's simultaneous territorial ambitions and naval expansion reveal a coordinated strategy of projecting American dominance. The legal setback on Venezuela shows courts remain willing to check executive power even as Trump pushes boundaries.

MARKETS

Gold Hits Record Fiftieth High This Year

S&P 500 nears record amid Santa Claus rally hopes despite economic uncertainty.

Gold hits 50th record high this year.

Global equities extended their record run for a fourth consecutive day as the anticipated year-end Santa Claus rally gained momentum. The S&P 500 sits just 0.3% from its all-time high reached earlier this month.

Gold reached another all-time high, marking the fiftieth record-breaking day in 2025, while silver also hit new peaks. Copper surged above $12,000 per ton, its highest ever, driven by mine outages and trade disruptions linked to Trump's tariff policies.

Tuesday brings delayed economic data including third-quarter GDP estimates, expected at 3.2% versus the previous 3.8%, and consumer confidence figures. Markets close early Wednesday and remain shut Thursday for Christmas.

The Santa Claus rally has historically been positive 80% of the time since 1928, averaging 1.6% gains. This year's alignment of precious metals surging alongside equities suggests investors are hedging against multiple scenarios simultaneously.

TECHNOLOGY

AI Agents Begin Workforce Shift

SoftBank advances a proposed $22.5 billion OpenAI investment as AI-linked layoffs surpass 54,000 in 2025.

AI contributed to more than 54,000 planned layoffs globally in 2025, a report says.

By late 2025, AI agents have moved from experimental deployments to early operational use, increasingly updating infrastructure, resolving customer issues, transferring funds, and managing enterprise software tools with minimal human oversight. This transition signals a shift from AI as a support assistant to AI as an increasingly independent operational actor within organizations.

AI contributed to more than 54,000 planned layoffs globally in 2025, according to employment data tracking automation-driven workforce reductions. The World Economic Forum projects that up to 92 million jobs could disappear worldwide over the next five years as AI reshapes white-collar work, even as new technology-driven roles emerge.

Governments and corporations are responding in parallel. The US National Institute of Standards and Technology invested $20 million to establish two AI research centres focused on manufacturing and cybersecurity for critical infrastructure. Meanwhile, SoftBank is working to finalise a proposed $22.5 billion funding commitment to OpenAI, underscoring growing investor confidence in large-scale AI deployment despite mounting labour disruption.

Longstanding fears that AI would replace human labour are now being partially realized, particularly in cognitive roles where routine analysis and execution can be automated by AI agents. However, displacement does not imply obsolescence. Human skills are increasingly being redeployed toward oversight, governance, complex decision-making, and relationship-driven work—areas where accountability, judgment, and trust remain difficult to automate.

💰 CORRUPTION, RACKETS & DUBIOUS FINANCE

Mistrial in High‑Profile New York Influence Case

A Brooklyn federal jury failed to reach a verdict in the corruption trial of former top New York governor aides accused of acting as unregistered agents of China, bribery, conspiracy, and bank fraud. The judge declared a mistrial after jurors deadlocked on charges tied to pandemic‑era contracts and alleged illicit financial schemes. Prosecutors say they will retry the case in early 2026. Critics argue the outcome underscores how complex influence and financial corruption cases often struggle to reach resolution in US courts.

The case focused on accusations that the defendants leveraged political access to benefit foreign interests and secure state contracts during the pandemic, allegedly concealing proceeds through elaborate financial maneuvers and luxury purchases. Prosecutors portrayed the scheme as part of a broader pattern of exploiting political networks for personal enrichment, while defense attorneys framed the actions as routine diplomacy and bureaucratic negotiation.

Legal analysts say mistrials in high‑stakes corruption cases reflect challenges prosecutors face in translating intricate financial evidence into unanimous jury decisions. Complex money trails, layered transactions, and overlapping allegations of fraud and influence often blur the lines between aggressive lobbying, ethical gray zones, and criminal conduct—especially when national‑security narratives intersect with routine state‑level governance.

WARS

Large‑Scale Drone and Missile Assault on Ukraine Ahead of Christmas

Russia unleashed a major offensive overnight, deploying more than 650 drones and dozens of missiles against Ukrainian territory.

Russia intensifies war effort as the West prepares to celebrate Christmas.

The strikes represent one of the largest escalations in 2025, signaling a renewed focus on long-range drone warfare and infrastructure targeting. Ukrainian forces scrambled to intercept incoming drones, while emergency crews worked to restore power and water to affected regions. Western governments condemned the attacks, pledging continued support and additional defensive aid.

Analysts warn the offensive could heighten tensions in Eastern Europe, strain Ukraine’s defensive posture, and complicate ongoing peace negotiations. It also underscores Russia’s growing reliance on autonomous systems to project power at scale, raising concerns about the proliferation of similar technologies in regional conflicts.

The timing and scale of the attacks demonstrate a strategic intent to apply pressure during a sensitive period, both psychologically and operationally. Beyond the immediate humanitarian impact, these strikes highlight how modern conflicts increasingly blend conventional and autonomous capabilities, challenging traditional deterrence and response frameworks.

ECONOMICS

Consumer Confidence Falls to Multi-Year Low

Economic uncertainty and inflation have made US consumers less confident.

The Conference Board’s Consumer Confidence Index fell, with short‑term economic expectations notably weak.

US consumer confidence fell sharply in December, reaching its lowest level since tariffs were implemented earlier this year, according to data released today. The Conference Board’s Consumer Confidence Index dropped to 89.1, down 3.8 points from last month, with short‑term economic expectations notably weak. Consumers cited inflation and trade policy uncertainty as key concerns weighing on sentiment..

The December reading marks the 11th consecutive month below the 80‑point threshold often associated with recession risk, underscoring sustained apprehension among American households about the economic outlook. Evaluations of current conditions also declined sharply, suggesting that both spending and hiring intentions may soften in early 2026. Economists note that persistently low confidence can feed back into slower retail sales and business investment, compounding existing macroeconomic headwinds in the US economy.

The drop in consumer confidence highlights how policy‑driven economic uncertainty—especially surrounding tariffs and inflation predictions—can have ripple effects deep into household spending patterns. Even modest contractions in sentiment can translate into tangible shifts in economic behaviour, particularly in the retail and services sectors where consumer demand is foundational. Prolonged weakness in sentiment could prompt a broader reassessment of growth forecasts for the start of next year.

🕵️ INVESTIGATIVE JOURNALISM

China’s Secret AI Chips Trigger Global Security Alarm

China has secretly developed a prototype facility capable of producing next-generation AI chips that could rival Western technology, according to a Reuters exclusive. Described internally as a “Manhattan Project” for AI semiconductors, the program has drawn scrutiny from US and allied officials concerned about covert technology transfer, state subsidies, and opaque funding channels accelerating China’s chip ambitions.

The Shenzhen-based facility reportedly produces AI chips critical for advanced computing, including defence, data centre, and autonomous applications. Western governments have imposed export controls and investment restrictions to slow Chinese access to leading-edge semiconductor technology, yet sources indicate the program has still advanced rapidly.

Insiders say the effort combines domestic capital with partnerships involving foreign entities, potentially bypassing international scrutiny. Analysts warn that opaque funding structures and hidden supply-chain deals may have allowed China to sidestep conventional market and regulatory barriers.

THE WEEK TO DEC 23, 2025

Trending in the US

This week’s Google search trends reflect a sharp mix of sport, shock, and spectacle. A blockbuster heavyweight bout drove the biggest surge in interest, while the sudden death of a well-known television actor prompted widespread attention. Aviation safety, newly released legal documents, and high-stakes college football also captured curiosity. The NFL dominated weekend searches, alongside lottery fever as the Powerball jackpot climbed to historic levels and a widely watched influencer fight added a dose of controversy.

1️⃣ Anthony Joshua — 5M+ searches

Anthony Joshua knocks out Jake Paul in 6th round to win heavyweight fight.

2️⃣ James Ransone — 2M+ searches

Actor James Ransone, known for his role in ‘The Wire,’ dead at 46.

3️⃣ Greg Biffle — 2M+ searches

NTSB holds Saturday briefing on Biffle plane accident.

4️⃣ Epstein files — 2M+ searches

Justice Department releases new batch of documents in Epstein investigation.

5️⃣ Oklahoma vs Alabama — 2M+ searches

Alabama overcomes 17-point deficit, bests Oklahoma in CFP opener.

WHAT THE MEDIA BURIED

US Commercial Property Faces a Quiet Refinancing Crunch

A new FDIC risk review warns that US commercial real estate is entering a period of heightened stress as hundreds of billions of dollars in loans approach maturity at interest rates many borrowers cannot afford. Office and retail properties remain under pressure from weak occupancy and falling valuations, limiting refinancing options just as credit conditions tighten.

Rather than triggering a sudden shock, banks are increasingly extending loans or restructuring terms behind the scenes, delaying losses but masking the scale of the problem. Regulators caution that this “extend and pretend” approach concentrates risk within regional and mid-sized banks that hold a disproportionate share of commercial property debt.