Already a subscriber? Sign in to unlock Premium on the website.

Use the “Sign in” link in any newsletter for one-click access.

From the Editor

The Meta ad-scam revelations, the CTM accounting fallout, and the FBI’s overtime disclosures are my stories of the week — not because they shocked me, but because they exposed how deeply systemic these failures have become. Three very different institutions, three continents, yet the same pattern: executives and agencies choosing opacity, expediency, or profit over basic accountability.

Meta’s internal documents showed the company anticipating billions from “high-risk” advertisers while delaying enforcement. CTM, a supposedly low-risk travel provider, overstated revenue by tens of millions of dollars. And the FBI quietly spent nearly a million dollars in a single week preparing redactions for the Epstein files, only acknowledging the scale of that work after litigation forced disclosure. Different sectors, same culture of normalized mismanagement.

If you would like a deep-dive report and support NEWS RaiVIEW, order Robots in the Newsroom. It analyzes how AI is transforming journalism — from automated reporting to editorial decisions — and what it means for credibility and the future of news. It’s essential reading for anyone tracking media and technology. Available to subscribers for $7.95. Get the report here

Please share this issue using the link at the end. Let’s dive into the stories shaping the week.

David Eifion Williams

Editor & Founder

TOP STORY

UK and US Immigration Systems Under Strain

Asylum pressures surge across two continents, exposing legal and logistical gaps.

The UK and US struggle with immigration arising from political asylum and economic migration.

The UK government has pledged to end hotel use for asylum housing by 2029, but progress is reversing as numbers rise. By September 30, 36,272 people were living in hotels—a 13% increase in three months. Record demand is intensifying the problem: the UK Home Office reported 110,051 asylum claims in the year to September, the highest annual total on record.

Local councils warn that health services, school places, and temporary accommodation budgets are being pushed well beyond planned capacity. Tensions continue to escalate as communities question costs and the slow transition into permanent housing. Meanwhile, the suspension of a UK executive at contractor CTM, for alleged overcharging related to the Bibby Stockholm barge, has renewed scrutiny over outsourcing and accommodation contracts. The Bibby Stockholm, moored off Dorset, was used to temporarily house asylum seekers when hotel capacity was exceeded and has now been decommissioned.

Other major economies face similar pressures, though responses diverge. In the United States, US Immigration and Customs Enforcement (ICE) continues to rely heavily on detention and removal processes, while federal courts repeatedly challenge practices that limit migrants’ legal rights, such as access to hearings or lawyers—basic protections known as due process. Long backlogs, uneven legal access, and inconsistent facility standards compound pressure on the immigration court system.

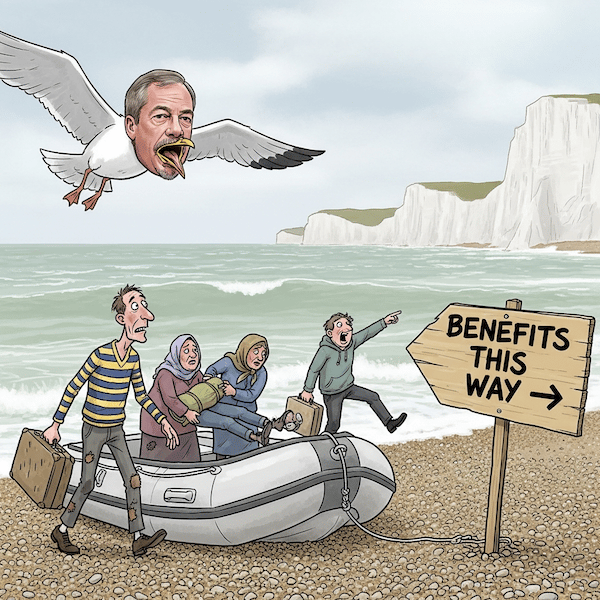

UK officials argue that hotels, though costly, meet legal duties under domestic law and the 1951 Refugee Convention to prevent destitution while asylum claims are processed. Yet the volatile increase in hotel numbers, combined with delays or abandonment of military-site alternatives, underscores the government’s inability to meet its own timelines and is helping to drive support for Nigel Farage’s populist, anti-immigration Reform party.

By comparison, Canada channels migration through structured labour programs, sponsorships, and regulated asylum pathways. Still, rising arrivals strain housing, services, and local integration efforts, showing that even systems with clear rules face real-world pressures.

Migration surges expose the cracks between legal duty, policy, and capacity. Communities, governments, and migrants alike are forced to confront a reality where human need often outstrips planning and resources.

STOCKS & CRYPTO

US Markets Slip Amid Investor Caution

Volatility kicks off December as key US economic data looms.

US stock markets begin December with a fall.

U.S. stock markets opened December with sharp declines after a late-November rally. Investors cite inflation worries, interest-rate policy, and global economic uncertainty as drivers of the drop.

Major indices fell as market sentiment turned cautious. Analysts warn that even small signs of policy shifts can unsettle equities and other risk assets.

Cryptocurrencies and other digital assets are also bracing for volatility. Bitcoin and altcoins may react sharply to upcoming U.S. economic reports and speeches by policymakers.

Investors are weighing optimism from recent gains against rising uncertainty. Even small policy signals can ripple through markets worldwide.

TECHNOLOGY

Cybersecurity Updates Intensify

Governments and firms prepare for quantum threats amid new regulations.

The quantum era of computing poses threats and opportunities in cybersecurity.

Legislation in multiple countries is aiming to tighten cyber defense standards. Companies will soon face stricter requirements for protecting sensitive data and reporting breaches.

Quantum-readiness initiatives include upgrading encryption, testing algorithms, and investing in next-generation security tools. Governments are also collaborating with private firms to anticipate cyber threats before they materialize.

A parallel challenge is the rapid rise of AI-driven cyberattacks, which are becoming more automated, adaptive, and difficult to detect. Security teams report that intrusion attempts now evolve in real time, forcing organizations to accelerate investments in defensive AI systems, continuous monitoring, and zero-trust architectures.

Cybersecurity is no longer just a tech issue—it’s central to national security. Companies and governments alike must adapt quickly to a quantum future.

💰 CORRUPTION, RACKETS & DUBIOUS FINANCE

Swiss Charges Hit UBS over Mozambique “Tuna Bonds” Scandal

Swiss prosecutors filed criminal charges against UBS (successor to Credit Suisse) and a former Credit Suisse compliance officer, accusing them of failing to prevent money‑laundering tied to a $2 billion loan scheme to Mozambique’s state‑owned tuna fleet. The case centers on a suspicious $7.9 million 2016 payment, of which about $7 million allegedly ended up in UAE accounts, transfers that should have triggered mandatory suspicious‑activity reports that were reportedly never filed.

Belgian Police Raid EU Diplomatic Service in Fraud Probe

Belgian police raided the headquarters of the European External Action Service (EEAS) in Brussels and the College of Europe in Bruges, detaining three suspects as part of a suspected fraud investigation involving a 2021–2022 tender for a new EU Diplomatic Academy. The probe — led by the European Public Prosecutor's Office (EPPO) with support from the European Anti-Fraud Office (OLAF) — concerns alleged procurement fraud, conflicts of interest, and possible breach of professional secrecy, suggesting the winning institution may have had prior inside knowledge of the tender. If proven, the case could shock the heart of EU diplomacy and raise serious concerns about transparency and financial stewardship at the highest level of EU institutions.

ECONOMICS

China Eases Export Rules as Europe Invests

Rare-earth licences and trade tensions shape global supply chains and investment flows.

China welcomes European investors to expand operations.

China has issued its first batch of streamlined licenses for rare-earth exports, easing controls imposed earlier this year. The move is aimed at supporting key industries like electric vehicles, electronics, and defense while reducing trade frictions with the US.

Despite rising geopolitical tensions, many European manufacturers continue expanding operations in China. Companies are drawn by low production costs, efficient supply chains, and favorable export conditions following Chinese currency depreciation.

The combination of eased rare-earth rules and foreign investment signals China’s intent to maintain global industrial influence. Analysts warn, however, that dependence on China exposes European firms and global supply chains to political and economic risk.

China is recalibrating its role in global supply chains while Europe balances opportunity against strategic risk. Investors and policymakers are watching closely.

WORLD

Peace Push Meets Battlefield Reality

Diplomatic moves clash with renewed fighting and strategic escalation in Ukraine.

Zelenskyy and Putin: is peace on the way?

Peace efforts are accelerating as US envoy Steve Witkoff and Jared Kushner prepare to meet Russian President Vladimir Putin in Moscow, bringing a revised US‑backed peace proposal into focus. Kyiv’s leadership calls territorial integrity the “biggest challenge” ahead of talks.

But on the ground the war rages on: Ukraine has stepped up attacks on Russia’s oil “shadow fleet,” targeting tankers to disrupt Moscow’s energy revenues. Meanwhile Russian forces continue to press offensives; both sides report skirmishes around contested cities.

European allies, including European Union states, are signaling readiness to extend military support for Kyiv, even as internal political debates rise over long‑term aid commitments.

Winter fighting could determine control of key eastern cities, while diplomatic talks risk sidelining Kyiv’s core security demands. Both battlefields and negotiation tables are now critical to Ukraine’s survival. International support and winter conditions will likely shape the next phase of the conflict, testing Ukraine’s resilience and strategy.

🕵️ INVESTIGATIVE JOURNALISM

FBI Redacted Jeffrey Epstein Files at Cost of Nearly $1 M

Bloomberg investigative reporter Jason Leopold’s civil lawsuit under the Freedom of Information Act required the FBI to provide documents that show during the week of March 17, 2025, the agency spent at least $851,244 in overtime to mobilize 934 agents tasked with reviewing and redacting materials from the Epstein files under an initiative called the Epstein Transparency Project 2025. The documents do not verify claims that the overtime was specifically used to remove former President Trump’s name or that the payments were exclusively for “redaction training.”

Scam Ads Brought in Hundreds of Millions for Meta

Internal documents obtained by Reuters reveal that Meta projected roughly 10 % of its 2024 revenue — around US$16 billion — would come from ads involving scams and banned goods across Facebook, Instagram, and WhatsApp. The documents highlight a deliberate tension between revenue growth and user safety, raising questions about corporate priorities.The memos show that Meta’s enforcement policy relied on a very high certainty threshold: only advertisers flagged as 95 % or more likely to be fraudulent were immediately banned.

THE WEEK TO DEC 2, 2025

Trending in the US

1️⃣ Chiefs vs Cowboys — 5M+ searches

Chiefs-Cowboys on Thanksgiving: Dallas win 31-28.

2️⃣ Stranger Things Cast — 2M+ searches

Stranger Things season five review – this luxurious final run will have you standing on a chair, yelling with joy.

3️⃣ College football playoffs — 2M+ searches

Set to make Tigers nation's 'best,' Kiffin introduced at LSU.

4️⃣ Bears vs Eagles — 2M+ searches

Bears beat the reigning Super Bowl champion Philadelphia Eagles 24-15

5️⃣ Michigan vs Ohio State — 2M+ searches

Ohio State’s 20-play drive that destroyed Michigan’s spirit.

WHAT THE MEDIA BURIED

$300 Million Pledged for Climate-Health Research

Philanthropies at COP30 in Brazil committed $300 million to tackle the human health impacts of climate change. Funding will focus on heat, air pollution, and infectious diseases in vulnerable communities. It’s a significant step toward protecting populations before disasters strike. Private donors are investing in research to understand and prevent climate-linked health risks. The move signals that tackling climate change is no longer just an environmental or political issue — human health is now center stage.

CTM Hit by £78m Revenue Scandal as Shares Stay Suspended

Global corporate‑travel provider Corporate Travel Management (CTM) admitted its UK and Europe arm overstated revenues by approximately £58.2 million ($72.8 million) in 2023–24, and an additional £19.4 million ($24.3 million) for 2025, after a forensic audit by KPMG. CTM suspended its UK/Europe CEO, Michael Healy, and postponed its full‑year results, likely triggering refunds and signaling deep governance failures in a sector often assumed low‑risk.

CTM launched a full external governance review and is contacting affected clients to process refunds where appropriate. The company admitted that some irregular revenue related to major customer contracts concluded between 2021 and 2023 — about £45.4 million ($56.8 million) — is now under scrutiny, which could lead to further restatements or refunds.

CTM’s shares remain suspended on the Australian Securities Exchange, and the firm has withdrawn its FY2025 guidance. It has not provided a new timeline for resuming trading or publishing final financial statements.